Have you ever wondered, “How much is my house worth?” House prices can change significantly in just a few months. Recently I did a sales appraisal for a client and told her to expect a sale price of around $800,000. Then by the time the property was ready to come onto the market new research showed it should sell for around $850,000 and it ended up selling for $880,00. Real estate decisions require accurate house valuation tools. A good place to start is ti find a house valuation tool online. Modern platforms combine market data, recent sales, and local trends to provide detailed property value estimates. Homeowners, buyers, and investors now rely on these digital tools to get quick and reliable property estimated values.

House valuation tools accuracies

While these online house valuation tools are very convenient and easy to use, the data they provide needs to be taken as a very rough guide. A real life example of this is an investment property I own in Buderim, here on the Sunshine Coast Qld. Online tools indicate that it would sell for around $1 Million dollars. Sadly for me I know thats not correct. The price is more like $800,000. Yep $200k less.

Before you think, it’s outrageous how these online house valuation tools could get it so wrong, you need to realise, these tools don’t know all the data. For example : Online my investment property in Buderim shows as 2 car parking. Which is a space for 2 cars, this property has no garage at all, zero and this will affect the sale price. It’s also on 880 sqm of land, but these online house valuation tools have no idea a lot of the 880 sqm is unusable. Adding to this online its shows as 4 bedrooms. Which it is but the 4th bedroom is very small and was initially part of the single car garage that someone converted. Other things these online tools don’t know about is the condition of the property. Mine is due for an “update”.

Example 2 : Another investment property I own in Maroochydore. Online house valuation ;tools indiavcte its current value is $1,250,000. They have come to this because an apartment on the same complex just sold of that. What these sites deport know is that The apartment that sold is smaller. only has one balcony, & 2 car spots. Compared to my apartment that has 3 balcony’s a parents retreats and 2 lock up garages. Which would include a sale price higher than $1,250,000.

The market offers many house valuation websites, which is a good place to start for you to Each platform uses different data sources that impact their accuracy. Our complete comparison looks at popular tools like OpenEstimates, NAB Property Insights, and Domain Price Estimates. We analyze their features, accuracy rates, and best uses. You’ll discover which tools match your needs and learn how to get the most accurate property value estimate.

How online house valuation tools can confuse owners

As you can see from above. These tools can be misleading, simple because while they have access to a lot of data they can’t understand the full picture like if the peop[rty is one a busy road, a hill, or has views. I see this a lot when I do sales appraisals for peopekp wanted to sell. Often they have been online and been excited about what an online tool has indicated to only be let down by me. or well the truth and the market.

How much is my house worth ?

So how do I know how much my house is worth in Buderim ? Using my RP Data subscription, I can do searches and manually to find other properties in the area that have recently sold in the last 6 months, that would be considered comparable. . Properties with no garages, properties with 3 bedrooms, property’s that are a little tired and bingo they are selling for more like $800,000.

Of course when using online house valuation tools working out how much my house is worth using online house valuation tolls can under value your property too., as in my example 2 above.

Overview of House Valuation Tools

Property valuation methods today include many different approaches that serve unique purposes in the real estate market. The rise of new online valuation tool techniques has created an easy way to find out “how much is my house worth” in minutes. But their are other altertinagtes and you will find here more acriatre ones.

Various ways for you to find how “how much is my house worth ?”

Property experts use four different types of valuation tools:

- Online Valuation Tools: Algorithm-driven platforms using up-to-the-minute market data and AI. Allow home owners fast way to find out how much is my house worth within minutes while sitting in your lounge room at home.

- Desktop Valuations: Remote assessments using public data and advanced algorithms. Used by real estate agents like myself and licensed valuers. Keeping mind that while these can be done by real estate agents they are not licensed valuers so can’t consider them a true valuations which is why we use term like Sales appraisal, or market opinion.

- Kerbside Valuations: External property inspections combined with market data analysis. Also sued by Used by real estate agents like myself and licensed valuers. Keeping mind that while these can be done by real estate agents they are not licensed valuers so can’t consider them a true valuations which is why we use term like Sales appraisal, or market opinion.

- Full Property Valuations: Detailed internal and external inspections of the property. You van use a fully licensed property valuer for a very detailed report who will charge you a fee. Or for free you can have a sales agent do these for free , however these can’t be c called valuations they need to be called sales appraisals or market opinions.

Importance of accurate valuations

Accurate property valuations are a significant part of real estate transactions and financial planning. Mortgage lenders use these valuations to determine the loan-to-value ratio (LVR) and evaluate lending risks for home loans. Banks and financial institutions need these assessments to make smart decisions about mortgage applications and refinancing options.

Property owners need accurate valuations if refinancing. Property buyers needs accurate valuations when buyer to secure loan approval.

Certified Practicing Valuers (CPVs) bring reliability through their expertise and industry standards. These professionals create detailed valuation reports by combining market knowledge with systematic data collection. Their university degree and minimum two years of field experience add credibility to their assessments. For bank loans real estate agents valuations can’t be used.

Professional valuation costs vary between $450 to $1,000 for residential properties, depending on type and complexity. Usually covered by your bank when refinancing.

Top Online House Valuation tools

Major online platforms have transformed how Australians check property values and now give instant access to detailed market data and automated estimates. These digital tools continue to advance and provide valuable insights to property owners, buyers, and investors looking to value their property.

Realestate.com.au RealEstimate

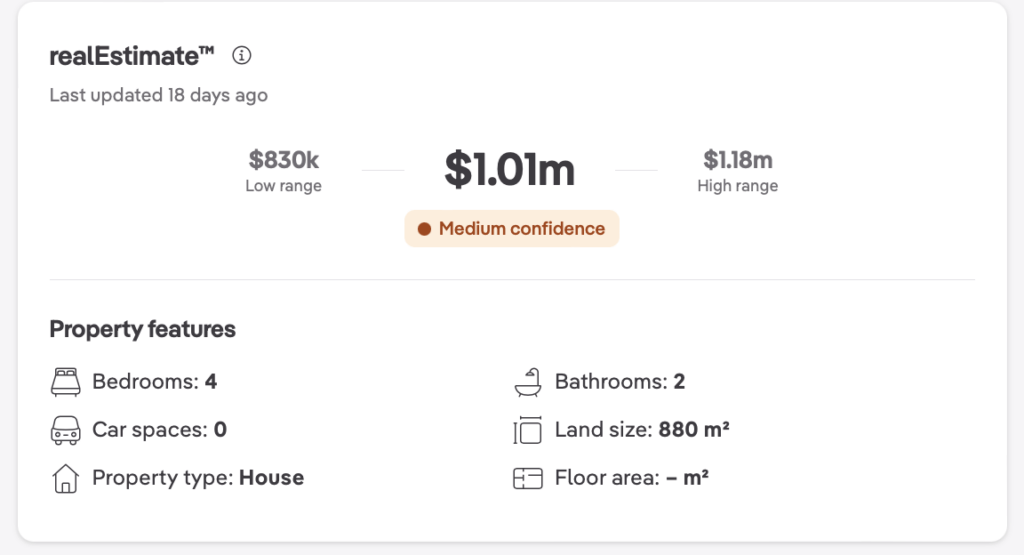

We all know realestate.com.au. Australia’s most popular real estate website. It’s realestimate service will give you an indication of the value of your home. At the time of writing using this service for my property in Buderim estimate was $830,000 low estimate – $1.01m medium confidence – $1.18m high range.

Open Agent

To use open agent to find out how much is my house worth , I needed to go through several pages of questions, add my email adress and phone number . Then they called me to tray and get me to agree to have a sales agent attend my property. In addition to this , you will see a screen encouraging you to reach out to some of the sales agents. The thing is the sales agent pay to be on the open agent system. So my advice would be to avoid this.

$895k low – $950k High confidence. – $1.04m high

domain.com.au

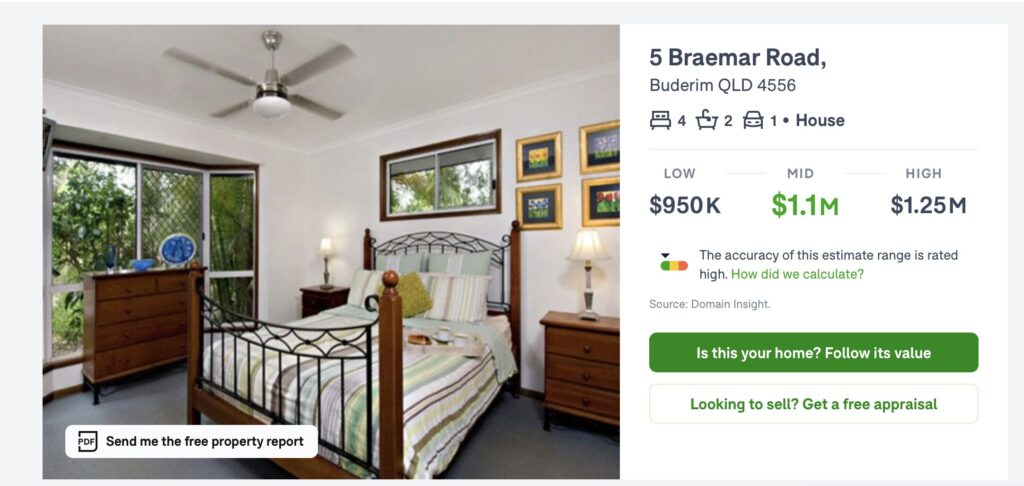

Let’s see how much is my house worth using Domain

Accuracy ratings for house valuation tools

Property valuation accuracy varies substantially based on characteristics and available data. Most platforms use a three-tier confidence rating system for their real estate property value estimates:

- High Confidence: Properties receive this rating with many comparable properties in the area and extensive property data

- Medium Confidence: Properties get this rating with decent comparable properties and reliable data

- Low Confidence: Properties fall here due to limited comparable properties or unstable local market data

Leading house valuation websites maintain accuracy within a 20% margin of error for standard residential properties in metropolitan areas. The margin can increase to 35% for premium properties or unique locations.

These platforms work best in high-density areas with modern housing developments. Property characteristics remain uniform, and sales data becomes abundant in these locations, but their effectiveness varies with unique properties or less active markets.

House valuation platforms offer distinct advantages and limitations that you need to consider during selection. A full picture of these features helps you pick the right tool that matches your valuation requirements.

Strengths and weaknesses

Automated valuation platforms deliver speed and convenience, but their reliability faces some key challenges as you can see above to answer the question of “how much is my house worth”

- Data Recency Impact: Recent sales data heavily drives these estimates, creating challenges in areas with few transactions

- Market Volatility: Quick market shifts don’t always show up immediately in automated valuations

- Property Uniqueness: Systems often miss the value of unusual property features or improvements

How to Choose the Right Online House Valuation Tools

As you can see from above the two main tools are realestate.com.au and domain.com.au you can use both these with confidence and is a good place to start to answer your question of “how much is my house worth”

Tips for Getting the Most Accurate Estimate

Property owners need accurate online valuations that depend on careful attention to detail. But they are really online a guide and a good place to start. To obtain a more accurate indicate of a property’s value property owners need to engage either a licensed valuer or a real estate agent.

Licensed Valuer

They will give you an unbiased valuation of your property. License valuers will charge you a fee. Many assume they will value your property low for banks, which is untrue.

Licensed real estate agent

I’m a licked real estate agent on the Sunshine Coast Qld. A likened agent is not allowed to do valuations, so we call them porp[erty appraisals, or market options, sometimes market updates. Most liced real estate agents do this free, in the home you will then sell your home with them. The challenge of engaged a real estate agent is many wil then hound you to sell. Some also are not prepared to put in the work to give you accurate information and instead, try and get an understanding of what you ho;e to sell for then simply agree. So when looking for a sales appraisal to know the most acuartre sale price be very careful which sals agents you reach out to . Of course if you have a property here ion the Sunsbine Coast this is something I can assist you with. No pressure. just professional, friendly help.

A mix of automated tools and professional insights makes valuations better.

Conclusion

Digital property valuation tools have changed the game for property owners, buyers, and investors who want to check real estate values. These platforms use smart algorithms with big databases and up-to-the-minute market data to give quick, available property estimates.

Getting the most from these valuation tools needs a good grasp of what they can and cannot do. Users get better results when they input detailed property information, keep their data current, and check multiple platforms. Major financial decisions still need professional valuations. These digital tools are a great way to get initial assessments but should not completely replace expert opinions from local real estate agents or professional valuers.

For those looking to value their property or get a comprehensive market appraisal, it’s advisable to use a combination of online tools and professional services. This approach ensures you get both the convenience of digital estimates and the accuracy of expert assessments. Remember, whether you’re considering investments, applying for a home loan, or simply curious about your property equity, an accurate and up-to-date valuation is crucial for making informed decisions about your real estate assets.

Other article you’ll find helpful

Selling upper home and buying another

How to have a stress free open home

Byron Miller has over 25 years experience in the real estate industry. A licensed real estate agent in Qld. Byron is based on the Sunshine Coast and sells properties for home owners and property investors . Ranked in the top 6% of real estate agents in Australia by realestate.com.au. Winder of 7 Rate My Agent Award. Sold 35+ Properties for record sale prices. Solid 30+ properties where pother sales agents tried to sell and failed.